EMI (Equated Monthly Installments) for home appliances is a financing option that allows customers to purchase appliances like refrigerators, washing machines, televisions, and other household items by paying in installments over a specified period. EMI risk management software plays a crucial role in helping lenders proactively identify and address potential risks associated with loan repayment defaults, thereby safeguarding the financial health of the institution and enhancing overall portfolio performance.

FDL Rapid specifically designed for growth loan businesses for home appliance products like Mobile, laptops, refrigerators, washing machines, televisions, and other household. Financers can enroll customer phones to send due EMI reminders, manage the EMI ledger, save customer documents on the cloud, manage loan agreements, help to find customers, and lock customer phones if they are not paying EMI on time.

Financer Can Reduce EMI Paymnets Default Risk By FDL Rapid Finance Mobile Locker with Zero Touch Enrollment.

The device will be auto enroll after a hard reset or flashing.

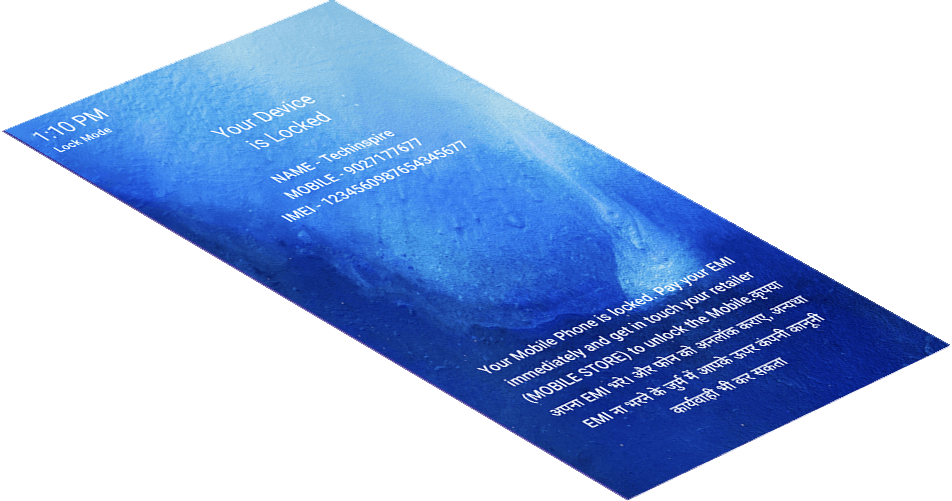

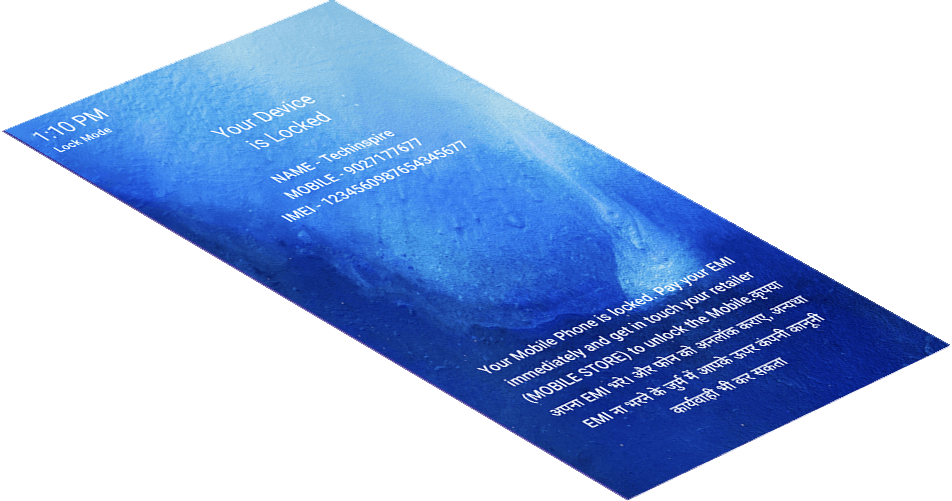

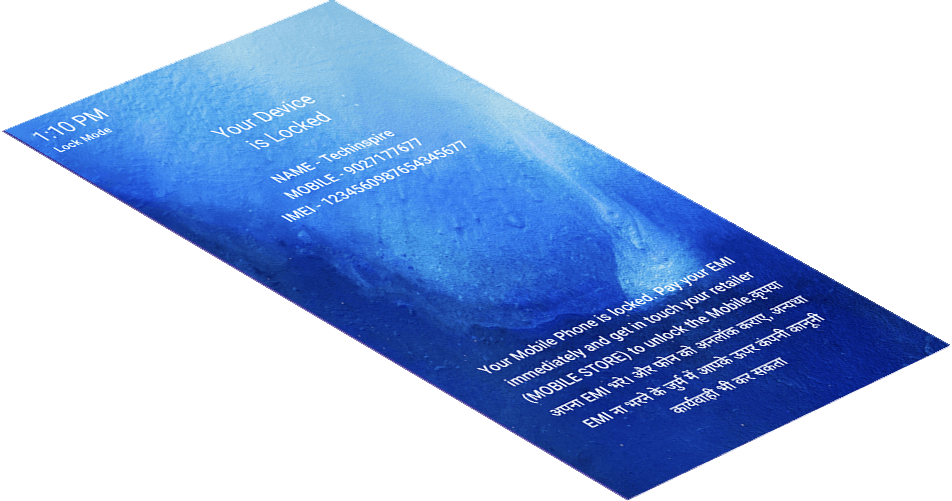

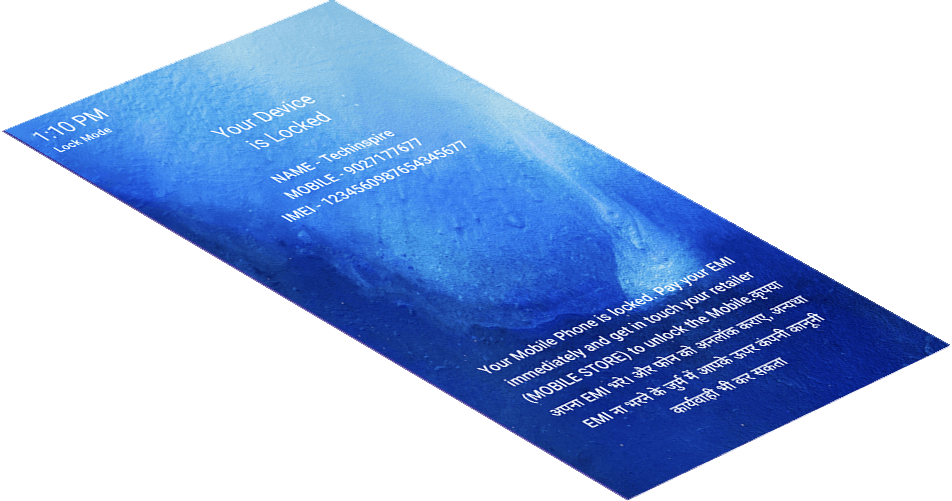

Remotely execute lock/unlock action to finance devices.

Finacer can manually/automatically send customized reminders to customer devices.

Finacer can store customer documents on the cloud

Any mobile device financer hassle-free runs self-finance businesses using FDL Rapid Mobile Mobile Locker.

FDL Rapid is an auto-enrollment technique after a hard reset and if the device bypasses FRF after that the device auto reset after every 2 hours.

You have to download FDL Rapid android application from the google play store and create an account with your business details.

FDL ACE and FDL Rapid both help mobile financers secure finance mobile EMI payments. FDL ACE provides 100% security with auto-enroll features after a hard reset and FDL PRO provides mannually enrollment features after hard reset.